Survey Points to Moderate Acreage Gains for Cotton in 2016

From Cotton Grower Magazine – January 2016

While U.S. cotton producers won’t set any records for number of acres planted in 2016, it appears they do intend to increase their cotton acreage in the coming season.

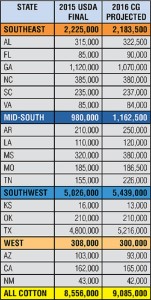

Following a year in which they planted only 8.5 million acres of cotton – the lowest total since 1983 – U.S. growers appear poised to increase cotton acreage by over 5% in 2016. American cotton producers have indicated they’ll plant 9,085,000 acres of cotton in 2016, according to data culled from the annual Cotton Grower Acreage Survey.

While it does represent a higher total than what was planted in 2015, this projection would still represent the second smallest yearly acreage total dating back to 1983. If American growers do plant the projected 9.085 million acres they’ve indicated here, it would represent an over 30% reduction in acreage from five years ago, when American cotton farmers planted 14.735 million acres of cotton in 2011, according to USDA data.

As always, the price of cotton in the commodity markets remains the single most significant factor in driving acreage totals. Prices have remained stagnant, hovering near the mid-60 cent trading range for much of the last calendar year, and many project that pattern to hold true for the foreseeable future. This has not encouraged new additions to cotton acreage in the U.S., although several other factors have helped cotton’s cause, according to responses gathered in the Cotton Grower Acreage Survey.

Many survey respondents referenced poor prices for competitive crops as a factor that may boost total cotton acreage. Another recurring theme in the responses, one that American producers will be encouraged by, was that yields in 2015 were overwhelmingly high. That factor is hard to ignore when making plans for the following season.

As per usual, Texas will lead the way in 2016 acreage with a projected total – 5.216 million acres – that would represent nearly 60% of total U.S. acreage. While that may come as no surprise, it is noteworthy that the Lone Star State is poised to increase acreage by a higher percentage than any other state in the Cotton Belt. Many industry professionals in Texas attribute that potential increase to the poor weather conditions that prevented untold acres from being planted in May of 2015. Producers on those thousands of acres – many of them in South and West Texas – are eager to jump back into cotton in the coming year.

Water shortages could continue to impact growers in the Far West, according to our respondents, although that does not appear to be a factor in much of the critical Southwest region.

“Cotton would appear to be a better option than grains due to grain prices, insect problems in sorghum, and the potential for improved weed control in cotton when and if new technologies are approved,” said one Texas respondent. “If acreage was down 10% last year, they may be up 5% in 2016.”

A few respondents in the Southwest cited the prevalence of module-building strippers and pickers as a factor that could drive more acres into cotton, as custom harvesting is an attractive option for many producers in the region.

Price, Price, Price

Without question, the biggest factor in cotton acreage is price. It was the most frequently referenced reason survey respondents gave when determining their acreage projections. But while cotton prices have floundered over the past year, competitive crops have also struggled.

“There are low prices in all commodities right now, and high inputs for each,” wrote one respondent from Mississippi. “So with all things being equal, it’s hard to ignore the good yields I made on cotton the last two years.”

In the Mid-South, where growers historically have more diverse cropping options, price parity is set to be a big boost for cotton acreage. Respondents in Tennessee and Mississippi indicated they plan to significantly increase cotton acreage in 2016.

Respondents in the Southeast, where roughly of quarter of all U.S. cotton acres will likely be planted in 2016, shared those sentiments.

“Cotton is very competitive for North Carolina growers,” wrote one respondent. “Right now, prices of all of our major row crops are suppressed, therefore I don’t see other commodities taking many acres away from cotton.”

Respondents in Georgia, traditionally the state with the second largest cotton acreage totals, indicated their planting patterns will remain largely unchanged.

The Cotton Grower Acreage Survey served to reinforce the fact that American cotton producers are highly attuned to commodity market fluctuations as well as industry developments.