ICAC: Abundance of Cotton Driving Prices Down

The basic law of supply and demand might not be influencing cotton prices as much as the government actions in India and China, according to the International Cotton Advisory Committee (ICAC), but that doesn’t mean growing stocks around the world are having no impact at all.

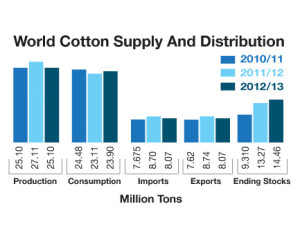

International cotton prices have declined in recent weeks, largely due to the expected second consecutive season of global stock increases. The ICAC Secretariat expects stocks to jump by 43% in 2011/12 to 13.3 million tons, to be followed by a 9% jump in 2012/13 to 14.5 million tons.

By the end of July 2013, global cotton stocks would represent 61% of global consumption – the highest stocks-to use ratio the industry has seen in more than a decade. Other factors participating in the recent price decrease include the arrival of rains in Texas, new uncertainties regarding the EU economy, and the strengthening of the U.S. dollar.

Stocks are expected to increase in spite of the fact that world cotton production is expected to decline 7% in 2012/13 (to 25.1 million tons) and global mill use is projected to increase by 3% (to 23.9 million tons) in 2012/13, driven by improving economic growth and lower cotton prices. Overall, global trade is expected to decline by 8% to 8.1 million tons. Chinese imports could fall from a record of 4.6 million tons to 3.3 million tons, while imports by the rest of the world could increase by 15% to 4.8 million tons, boosted by lower cotton prices and increased consumption.

In 2011/12, the vast majority (about 75%) of the projected increase in global stocks will take place in China, mostly within the national reserve. A portion of this reserve might be auctioned before the arrival of the new crop, to rotate stocks.

The Chinese government already announced a slightly higher minimum support price for 2012/13 and is expected to buy part of the new cotton crop. This suggests that the size of the Chinese national cotton reserve may increase further in 2012/13.Uncertainty surrounding the actions of the Chinese national reserve might also contribute to overall price volatility, ICAC says.

Source: ICAC. Edited by Mike McCue, Editor.