Q3 Preview: Evaluating the Impact of China’s Cotton Reserve

The global supply and demand of cotton can be affected by many variables (such as macroeconomic factors and inclement weather), so the fiber’s price fluctuates in a wider range than grains, and is more volatile too, including major surges and dramatic drops. That factor alone makes it difficult for China’s government to regulate its cotton market – but it is even harder for officials to balance the interests of multiple industries in the short term.

The biggest influence on the global textile industry today is the weakness of many major economies, particularly the United States and European Union. Until consumer confidence increases and consumers feel comfortable spending money on clothes again, there’s not much that can be done to impact the textile industry.

On the other hand, the greatest influence on the global price of cotton is man-made: the Chinese reserve’s buying policy and relatively tight quotas supply. In China specifically, the result of that policy is a large gap in the prices of imported and domestic cotton.

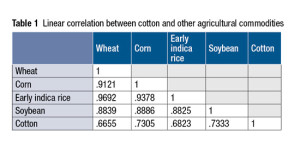

Cotton typically competes with grains for acreage in China. However, edible crops can’t be used by the textile industry, so the correlation between the price of cotton and the prices of the main grain crops is low (see table at upper right).

Because the government needs to protect farmers and maintain stable acreage for cotton, it is entirely reasonable that the cotton reserve sets the price according to the wheat/cotton price ratio. However, from the perspective of the textile industry, that is an unreasonable approach and puts textile manufacturers at a disadvantage.

Ultimately, the Chinese government can only protect one of the two groups – farmers or textile manufacturers – in a given period of time, not both.

Be sure to read the full story in Cotton International’s upcoming Q3 issue, which will feature the 2012 China Report. Watch for the issue in September!