Shurley on Cotton: Rocky Top and a Rocky Road

By Dr. Don Shurley

The Tennessee Vols hammered my beloved Dawgs on October 10. As it ends up, maybe my Dawgs are not all they were earlier cracked up to be, with or without their star running back. Rocky Top was a rocky road for the Dawgs.

There has always been talk and hopes that prices would mount a return to the upper 60’s and even the 70-cent mark – anything is still possible if striking the right balance of yet unknown supply and demand factors. This cotton market, however, still appears on a somewhat “rocky road”.

This is not to say that higher prices aren’t still possible. I’m not advocating that at all, because indeed that’s not necessarily the case. But it is time (past time) to carefully analyze alternatives and plan how to market this crop while also managing risk.

Producers in South Carolina, North Carolina and Virginia have been dealt a heavy blow with tremendous crop losses due to recent torrential rainfall. The cotton crop will likely be “zeroed out” in some areas. Prior to recent damage, the Carolinas-Virginia crop was pegged at a total of 1.28 million bales, with about 30% being in South Carolina, 55% in North Carolina, and 15% in Virginia.

Yield loss, especially in South Carolina, will be significant. There are also reports of cottonseed sprouting in the burr. This will result in additional income loss from the seed, as well as loss of fiber quality due to stain and reduction in Color grade.

Cotton has thus far struggled to gather any steam that might bring a more optimistic outlook. A look at recent intraday price movement illustrates this. After trending up for a couple of days, prices could not hold on September 30 and closed down. Subsequently, each attempt to rally back over the next couple of days was met with bearish forces, and the market closed down.

Reports say that the most significant amounts of rain fell on October 3-5 with subsequent flooding. It appears that the Carolinas-Virginia rain and subsequent expected crop damage, as well as other possible factors, did initially result in a price rally of roughly 2 cents/lb – but again, each day during this time, prices closed at or below the midpoint for the day. Prices have trended down closing at 61.61 on October 9.

So, both recent activity and the longer-term daily chart seem to suggest a level of resistance at roughly 62.50. Should things begin to look a little less “rocky,” prices could move a bit higher before hitting more resistance likely at 64 to 67 cents.

But the October USDA numbers, on balance, may not do much to improve the tone of the market. Most observers thought we would see a slight increase in the U.S. crop estimate, but the crop was cut slightly (by 90,000 bales) from the September estimate. Texas was lowered 100,000 bales, but Georgia was raised 100,000 bales. The impacts of rain in the Carolinas and Virginia will not be reflected until November. In terms of questionable U.S. crop size and quality impacting the market, the jury may still be out.

World production was lowered by 1.36 million bales, with reductions including China (700,000 bales), Australia, Brazil, and Pakistan. World use (demand) was lowered by 1.17 million bales, including reductions in China (500,000 bales) and Pakistan (400,000 bales). Ending stocks for the 2015-16 crop marketing year were raised 710,000 bales, however, due largely to a one million bale revision down in 2014 crop year use (demand) by China that was carried forward as larger 2015 crop year beginning stocks.

If your marketing plans involve holding cotton for possibly higher prices, don’t go bare-footed down the rocky road and get all cut up and bruised. Put your boots on. Know the risks, consider the pros and cons of each alternative, and evaluate plans carefully.

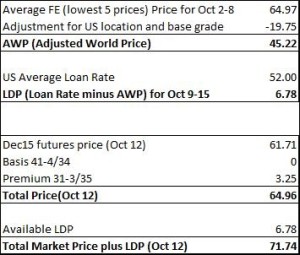

The Southeast basis for 41-4/34 is currently even (zero off) the December futures. The quality premium offered for 31-3/35 is +325 points (3.25 cents/lb). As we roll into picking time, there are several alternative marketing strategies to be considered. No action is guaranteed to be the best in terms of making you the most money. Each year is different and the results different.

If you hold any uncommitted crop in storage or on paper, there’s only one good reason for doing so – you hope (think) the market will go up. Whether in storage or on paper (like a Call Option), either way all you are doing is buying time that you hope will reward you in the marketing going up. If the market improves, any of several strategies can potentially make you money. But if the market goes down, some strategies will result in less loss. That’s where each strategy has to be evaluated in terms of risk. I suspect some growers and marketing associations will likely end up using a combination of tools and strategies.

Take the LDP then Sell. The LDP changes every week depending on what happens to World prices (the Far East price) the previous week. The LDP for the week October 9-15 is 6.78 cents. This will change effective October 16, depending on what the FE price does this week.

The total money available based on today’s December futures close is 71.74 cents per lb. This will increase when futures and cash prices increase relative to the FE Price. It will decrease when futures and cash prices decrease relative to the FE Price. The FE price and futures tend to “track” together. If futures go up one week, the AWP and LDP will likely go down for the next week. So, one strategy is to take the LDP and sell while futures are going up and before the LDP adjusts down.

Take the LDP and Hold/Store. This can be a costly and risky strategy, but some folks do it. The LDP is easy up-front money and often too tempting to not take. But, the grower doesn’t want to then sell on a low market. But then those bales are no longer eligible for the loan, and interest and storage charges will accrue. If the market does improve, you now have to cover the charges to make it profitable.

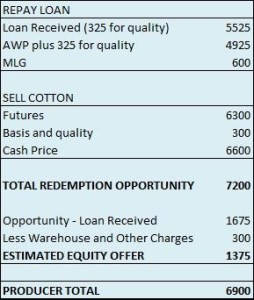

Store in the Loan. Assuming an LDP is available, you could forego the LDP and place the bales in the Loan instead. You’ll receive the quality-adjusted Loan Rate (52 cents/lb +/- quality premiums and discounts) on each bale. Once in Loan, you’ll then have up to nine months to redeem the cotton (repay the Loan plus any charges) or instead, receive a merchant “equity” offer.

The math of what happens in Loan is the same as with an LDP. If the AWP is less than the Loan Rate, the Loan is paid at the lower AW, resulting in a Market Loan Gain (MLG). If receiving payment in lieu of placing cotton in Loan, it’s called an LDP. If received after putting cotton in Loan, it’s called a MLG.

An “equity” is payment to the grower by a merchant that would make the grower indifferent between taking the equity or going through loan redemption. In exchange for the equity, the merchant assumes control of the cotton and makes the decision on when to redeem the loan. Since the merchant will typically then be responsible for paying warehouse and other charges, those charges, any fees, etc. are deducted when calculating the equity.

The following is an example. Merchants have a little different process and terminology, but results are the same or similar.

Taking the LDP and selling vs. going to Loan – which is best? This depends on what happens to basis, prices, quality premiums and discounts, and the AWP.

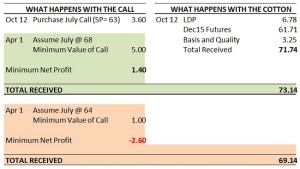

Sell, then Purchase a Call Option. A Call Option is an alternative to storing the crop. The Call premium is paid rather than incur any cost of storage. As a risk management tool, losses are limited to just the Call premium if the market goes down rather than go up as you hope.

When, like now, the AWP is less than the Loan rate, storage costs are reimbursed by the CCC, so storing in Loan is free.

When purchasing a Call, its value will increase when the associated futures price increases above the Strike Price of the Call. If futures fall below the Strike Price, the Call will have no value, but loss is limited to just the premium since the crop has already been sold. Examples are shown based on October 12 prices and assumptions about July futures.

IN SUMMARY. It’s thus far been a disappointing and frustrating year price-wise and, unfortunately for some growers, yield-wise also. The die is not cast for the final time by any means, and upside price potential is still out there. But, growers have to carefully evaluate the alternatives now available and the potential outcome of each if prices go up – and the risk of that outcome if prices instead go down.

Examples of marketing alternatives have been presented. The purpose of this is educational. The purpose for doing this is not to necessarily compare how they would compare penny for penny today. My approach is that if producers understand the basics and how the mechanics of each works, they can very well apply the appropriate numbers when the time comes.

Currently, the basis is good, and premiums for quality are good. This, combined with the available LDP, is likely to surprise producers in how good the total will be. Alternatively, the cotton can go to Loan and you play the MLG and equity game. This can work out just as well or better than taking the LDP. It also could not.

Growers should also be aware of and consider that good basis and quality premiums currently available may not hold forever – or they could. I’m just saying factor this uncertainty into your decisions.

Going the Call Option route can also work well. My view on Calls is that they are a way to continue to play the market while limiting any potential loss. Can money be made? Yes. Can money be lost? Again, yes. In either case, it’s equally important to manage risk.

Shurley is Professor Emeritus of Cotton Economics, Department of Agricultural and Applied Economics, University of Georgia