Key for Success in Bangladesh: More Reliable Sourcing Options

Despite difficult times in the last couple of years, Bangladesh emerged as an undisputed leader in the cotton and textile world, with a record $19.6 billion in textile exports in 2011/12 – twice what it was five years ago. The towering export figure demonstrates unprecedented growth in a textile sector that has been developed by millions of hard-working people and scores of visionary entrepreneurs.

There are three factors that triggered the textile boom in Bangladesh over the last few decades: resources (an abundance of skilled labor, low energy costs and natural gas), opportunities, and policy directions. In recent years, Bangladesh has shown a significant increase in per capita income and improved lifestyles for the middle class. Above all, dedicated workers are willing to work extra when needed to meet the production target is a key to the robust growth.

Bangladesh has taken steps to expand and secure its markets, especially in Europe and the United States, while government policies have buoyed textile growth. Liberalizing the economy has also encouraged private sector investments. Two of the most important resources, labor (23 cents/hour) and power (gas energy costs 3 cents/hour) are abundant and cheap in Bangladesh. Tariffs in the spinning sector are strikingly absent, while imported yarns and fabrics are taxed heavily.

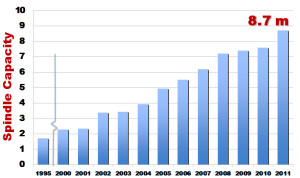

All of these factors have had synergic effects on the textile growth in Bangladesh. As a result, the country’s spinning industry has seen a phenomenal growth over last 20 years, expanding from 1.5 million spindles in 1996 to 8.7 million spindles in 2011.

Similarly, export in textile sectors has also seen a phenomenal growth, from $1.5 billion in 1994 to $19.6 billion in 2011/12. The quality of knit garments and the competitive advantage of Bangladeshi manufacturers allow them to capture the increasingly competitive markets in the U.S. and European markets.

Challenges in Sourcing Cotton

Bangladesh has been facing enormous challenges in sourcing cotton to feed its $20 billion apparel industry over the few years. For a country considered a rising textile power, the challenges have been painful reminders of the intractable problems plaguing Bangladesh. India, for example, has been serving as one of the most important sources of cotton for Bangladesh. However, for last couple of years, it has been proven to be one of the most unreliable and undependable sources.

Several events in the 2010/11 cotton season have changed the landscape of the Bangladesh cotton industry. It is widely believed that these events will continue to have impact on the cotton industry for a foreseeable period of time. Series of Indian Governmental ban on cotton export in 2010 and 2011 triggered a rally in the cotton market that never experienced in the history of cotton. As a result the New York ICE futures settled at an unprecedented level of 214 cents/lb in March 2011. Bangladeshi spinners took a considerable position in Indian cotton before the export ban in April 2010, only to find the Indian merchants default on contracts en masse, citing the governmental export ban. However, the import data suggests that the Indian cotton continued to pour in Bangladesh with a peak volume of 52,000 tonnes just in April 2010. Unfortunately most of these cotton didn’t reach the intended buyers, but was deliberately shipped to other buyers for extra profit.

Panicked Bangladeshi buyers rushed to recover their losses and took random positions from international market, but the majority of Bangladeshi spinners have limited knowledge of commodity markets and the associated risks. They also do not have access to risk management tools such as derivatives trading. As a result, they found themselves in a situation where the price dropped more than $1.20/lb from their contracted price. As a result, a significant number of defaults in contracts with international merchants occurred, stigmatizing the entire cotton industry.

The New Way Forward

Central Asian countries, including Uzbekistan, Turkmenistan and Tajikistan, have been Bangladesh’s most reliable sources of cotton for decades.

Unfortunately, their market share in Bangladesh, currently 50%, has been dropping. Bangladesh should work more closely with these countries to stimulate trade and recapture their once mighty import share of 72% back in 2006.

In 2010, Bangladesh imported a record 770,832 tonnes of cotton. Central Asian Countries dominated the import share. India captured 28%, up from only 10% in 2006, and Uzbekistan lost significant market share to India since then.

A 40% decline in import volume was recorded in 2011 after the devastating year of Indian bans and subsequent market turmoil in 2010/11.

Bangladesh imported 478,471 tonnes of cotton in 2011. India lost 4% market share while Uzbekistan managed to maintain its 2010 levels. Australia’s rise to 6% market share has been remarkable.

A significant recovery in imported cotton volume

occurred through August 2012. In just eight months, the total import volume reached to 416,401 tonnes and it is expected that the volume will soon reach 2010 levels if the pace continues.

With current apparel exports reaching $20 billion a year, Bangladesh needs to import about 800,000 tonnes of cotton annually. A 2011 study conducted by McKinsey & Company suggests that the growth in apparel industry is likely to double by 2015 and nearly triple by 2020. If Bangladesh continues to expand its apparel industry at this pace, cotton consumption is also likely to double to 1.6 million tonnes by 2015 and triple to 2.5 million tonnes by 2020.

Volatility in raw cotton prices, coupled with concerns about possible export bans, has raised concerns among the apparel buyers from Europe and the United States, two of the top markets for Bangladesh. The country’s dependency on imported cotton poses sourcing risks; therefore, Bangladesh must work closely with countries that pose little or no risk to its supply. Central Asian countries, especially Uzbekistan, Turkmenistan and Tajikistan, would be the most natural and dependable sources of raw cotton for Bangladesh.

It is in the best interests of Bangladesh to promote sustainable cotton trading by recognizing the importance of the contract sanctity. We also need to emphasize preventive measures that could ensure the sanctity of contracts.

Three preventive measures that would help ensure sustainability in cotton trading and preserve sanctity of contracts:

1. Encourage mill owners to gain knowledge of

international trading practices and risk management. The Bangladeshi government and the business organizations such as the Bangladesh Textile Manufacturers Assn. (BTMA) and Bangladesh Cotton Assn. (BCA) can play important roles in providing institutional supports to train mill executives. Most cotton stakeholders in Bangladesh do not have access to hedging instruments, but the government can help establish a cotton and yarn exchange or allow the stakeholders to gain access to international hedging instruments to manage their risks.

2. Encourage mill owners to operate under the framework of the International Cotton Association’s (ICA) rules and bylaws. Mill owners should buy their cotton only from merchants who are ICA members.

Unfortunately, small and “new” exporters have been a major cause of contract defaults in last couple of years. It has now become a reality that these small traders/merchants will continue to play a role in international trading. The Government of Bangladesh, in collaboration with textile and cotton associations (BTMA, BCA and ICA) can play a vital role in bringing them under a common legal and trading framework consistent with international trading laws. The Bangladeshi government should also work with the Indian government to encourage merchants to operate under ICA rules and bylaws. Merchants need to be held accountable for defaulting on contracts. It is in the best interests of India’s government to ensure that the sanctity of contracts and credibility of the exporters, and the country as a whole, is preserved.

3. The Bangladeshi government, along with BTMA and BCA, should work closely with the World Trade Organization, ICA, and International Cotton Advisory Committee and the Indian government to ensure policy makers don’t put a ban on cotton exports. In the last couple of years, the cotton world has witnessed how governmental interventions can bring the market to the point of collapse. The unfettered movement of cotton is essential to restore the balance of nature.