Shurley: Could This Be the Beginning of Price Improvement?

If cotton prices are to improve, it’s got to start sometime, somehow. If improvement is to be in our future, the underlying economic fundamentals must begin to swing in that direction and market uncertainties diminish.

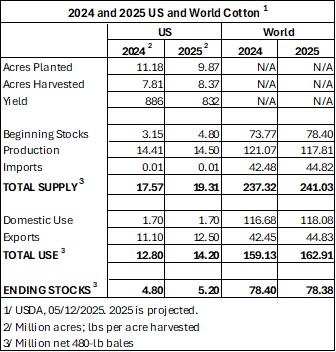

USDA’s May report is always the first projections for the upcoming new crop year. This month’s report might just be part of this start. In summary, the major takeaways from the report are:

- U.S. exports for the 2024 crop marketing year, after being dropped in recent months, were increased 200,000 bales from the April projection. This was not unexpected, as shipments have been above the previous 10.9 million bale pace. This projection could increase even further.

- U.S. exports for the 2025 crop year are forecast to increase 1.4 million bales above this season.

- The early forecast for the 2025 U.S. crop is at 14.5 million bales. This is assuming the March intended planting number and average abandonment and yield.

- World production is forecast to be down over 3 million bales for 2025. This comes primarily from China and Australia. Brazil is projected to be up 1.25 million bales.

- World demand/use is projected to increase 1.4 million bales or 1.2% for the 2025 crop marketing year. Increases are noted for India, Bangladesh, Vietnam, and Turkey. No increase is projected for China at this time.

- U.S. export market share is expected to increase from 26.15% for the 2024 crop to 27.88% for the 2025 crop. But Brazil is forecast to still out export the U.S.

These May numbers will be watched closely by the market in the coming months. It’s very early. And while some of this is potentially positive, much is still unknown. I will tell you, for example, that USDA has a history in recent years of tending to overestimate use/demand and then having to revise that number down in subsequent reports.

U.S. acreage, crop condition, and yield is also subject to change and will change. U.S. ending stocks are expected to rise based on assumed acreage, yield, and total use.

Summary and Outlook

USDA’s May numbers could be the foundation for better prices. The report does show some potentially improved fundamentals. But prices going forward will still be sensitive to how this outlook changes – specifically the size and condition of the U.S. crop, U.S. exports and potential, and World Use. Reduced uncertainty and improvement in the impacts of the Trump tariff situation (particularly with China) will also be a factor.

The stage could be set. But if prices are to break out of the long-standing 67 to 71 cents range, actuality must begin to match more optimistic projections.

Comments and opinions expressed in this article are solely those of the author.