Shurley: Cotton Prices Struggling in the Battle to Recover

The last couple of weeks, cotton has occasionally made some progress up but has failed to hold. December futures has declined and appears settled at the same area of lows set back in July in the 83-to-90 cents area.

This past week (week of Oct. 10), for example, December gained 4.63 cents on Monday and Tuesday – including a limit up move on Monday – but then declined 5.71 cents the remainder of the week. This type of volatile and erratic movement has been characteristic of this market and frustrating for growers.

Weakness in price is due to continuing and mounting worldwide demand concerns including inflation and interest rates here in the U.S. and fluctuations (especially higher) in the value of the dollar.

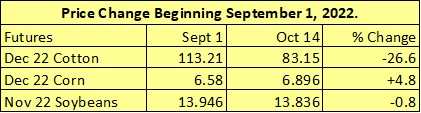

Economic and demand concerns have not impacted all commodities the same. Compared to corn and soybeans, for example, cotton appears to have been negatively impacted much more. Since Sept. 1, cotton price has declined over 26%, corn has increased almost 5%, and soybeans are essentially unchanged.

Of course, each commodity has its own overall U.S. and world supply and demand picture.

Cotton price has also been impacted by a larger than expected U.S. crop despite adverse weather issues. Demand concerns, combined with a larger than expected crop, have not been kind to prices. Still, it seems to be overriding economic and demand factors that are in the driver’s seat.

USDA’s October production and supply/demand numbers were not helpful to cotton’s situation. Here’s a brief summary:

- The U.S. crop was essentially unchanged from the September estimate. Yield was unchanged or increased in nine states, including Texas.

- Projected U.S. exports for the 2022 crop year were cut 100,000 bales.

- World use/demand for the 2022 crop year was cut approximately 3 million bales, including reductions for China, India, Pakistan, and Vietnam.

- Needed imports were trimmed for China, Turkey, Pakistan, and Vietnam.

- World ending stocks were raised over 3 million bales.

There is still belief among some within the industry that the U.S. crop simply is not as large as USDA’s 13.81 million bale estimate. Unless any adjustment down is significant, however, a cut in the U.S. crop alone is not likely to get prices back on a strong path upward unless economic and demand fears also subside.

Weekly export reports in recent weeks have not been particularly strong but have been weak in some weeks but more encouraging in others. Last week’s report was improved in sales but down in shipments.

December 2023 futures are currently at 76 cents. This is well below the full cost of production and would portend a significant reduction in acreage where producers have choices. The market is currently signaling to grow less cotton. Less acreage next season, an improvement in demand, or a combination of both may likely be needed to get price kicked in the right direction.