Shurley on Cotton: Have Prices Reached Yogi’s Fork in the Road?

By Dr. Don Shurley

New York Yankee great Yogi Berra died this past week. One of the most famous of his Yogi-isms would be “When you get to a fork in the road, take it.”

Undoubtedly, cotton prices are at a fork in the road. Will prices be able to hold the 60-cent level and perhaps eventually recover to move higher or will prices erode further into the 50’s? No one is sure of the answer, but most seem to agree that until fresh/new buying appears, it is difficult to stop the bearish tone that has suddenly enveloped the market.

By “buying”, I mean an increase in buying of actual cotton or the purchase of cotton futures by investors, speculators, and others, signaling that enough folks believe cotton has finally gotten too cheap. Buying activity (demand) is needed and/or shock(s) on the supply side.

Prices (Dec futures) closed at 60.31 cents per lb on September 24. The 60-cent mark is a psychological mark, and prices, thus far, seem to be bouncing off the 60-cent level and hopefully attempting to establish a new floor of support.

Only time will tell. There are many negatives out there that currently pressure the market – the U.S. crop has gotten bigger (USDA Sept estimates vs. Aug estimates) and may get even bigger, World use appears to be weakening, the India crop is still an unknown, and there’s always the uncertainty of what is going on in China (economy, crop and imports).

If all these things work out negatively, prices could indeed find the 50’s. If, however, some of these worries turn out better than expected, prices could recover. What we hope will materialize as a “bounce” or consolidation at the 60-cent level would be the market’s way of saying enough is enough – for now.

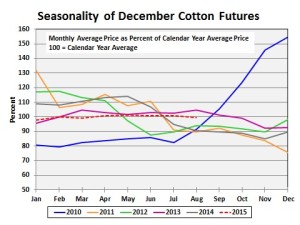

Those that advocate that this market is definitely headed lower site the seasonal pattern of lower prices at harvest due to the delivery of supply and the widening of the basis.

In the past five years, December futures prices have trended down into harvest time four of those years (2010 being the exception). Thus far, 2015 is following a pattern similar to 2013 – prices relatively flat for most of the year before falling off late.

December 2013 futures were mostly in the 80’s. One of the uncertainties this year has to do with the fact that prices have been low and disappointing. I doubt that more than 15 to 20% of the crop has been contracted for harvest delivery. I sense that most of the crop may be headed to Loan. Unless contracted for harvest delivery, the only other cotton likely headed into the supply chain will be that cotton on which an LDP is taken – and then only if the cotton is then sold on the spot market.

In other words, I wonder if the normal harvest time seasonality of lower prices due to a glut of available supply is applicable. Prices may decline, but other reasons, like weak demand, may also dictate it.

The LDP available for the week beginning September 25 will be 7.39 cents per lb. This compares to 5.63 cents for the week ending September 24.

The Basis December in the Southeast is currently -50 points December for grade 41/4-34. The premium being offered for 31/3-35 is 325 points. For 31/3-35, taking the LDP and selling the cotton would result in total money received of 68.69 cents per lb, based on today’s price and available LDP.

Premiums for quality are expected to be good. Growers are encouraged to preserve both yield and quality by defoliating at the proper time and then harvesting in a timely manner.

Shurley is Professor Emeritus of Cotton Economics, Department of Agricultural and Applied Economics, University of Georgia