So What Now?

Last week, USDA’s July cotton supply and demand report showed a marked increase in projected yield in 2010/11, rising from June’s estimate of a 16.7 million bales to 18.3 million. If that holds, this will be the largest U.S. crop since 2006 (2007’s crop also came in at 18.3 million bales).

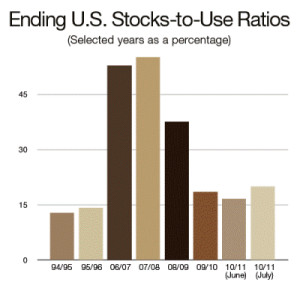

USDA also raised projected carryover from a critically low 2.8 million bales in June, to a seriously low of 3.5 million. The stocks-to-use ratio of 20 percent is less than half of what it was in 2006/07 and 2007/08.

Here’s an attention grabber: In 2008/09, we produced a 12.3-million bale crop and had a stocks-to-use ratio of 55 percent. If projections hold, we’ll produce 7 million bales more in 2010/11, and have a stocks-to-use ratio that is 35 percent lower.

The leading economic indicators are still very shaky and could negatively affect demand at some point, but USDA says U.S. exports will increase from 13.28 million bales in 2009/10 to 14.3 million in 2010/11. Total world use is projected to increase by 3 million bales over 2009/10, and is up 10 million bales over 2008/09.

As you might expect in the face of projections for a big new crop and very low stocks of old crop, cotton futures have been a roller-coaster ride. The ICE July contract was over 86 cents in April, dropped to just over 77 in early June, rose again to about 85 cents in late June, and is now at around 82 cents. The same is true for ICE December: It was at 74 cents in early June, spiked to just under 80 cents in mid-June, and is now at 74 cents.

So now what? Yes, we have a bigger crop coming in if conditions hold, but we are also projected to have increased exports. Yes, carryover was increased by 700,000 bales, but that 20 percent stocks-to-use ratio is still bullish.

From here until the end of harvest, it’s about weather, weather and then the weather. That’s a drum we’ve been beating since the end of planting. The High Plains, Coastal Bend and Rio Grande Valley areas of Texas are in extremely good shape moisture wise, and now need to pile on the heat units. NOAA is projecting a warmer than normal period through September for the Cotton Belt.

In India, the monsoon rains may have been a little late, but they came with a vengeance – so much so that sadly, there are reports of over 200 deaths from flooding and mudslides.

In China, a report last week showed drought conditions developing in some of the grain-producing areas, but rainfall had been normal in the cotton-producing areas of the northwest. If you’re interested in tracking moisture conditions in China, see: http://bcc.cma.gov.cn/Website/index.php?ChannelID=77&show_product=1.